Online trading has picked up dramatically in India. Lakhs of new investors have joined the market hoping to improve their financial situation and earn decent returns. They can do so through many different avenues, although ExpertOption remains the preferred online trading platform for Indian investors. Launched in 2014, ExpertOption is a recognised international broker that allows Indian investors access to many global markets.

Using ExpertOption, Indian investors can invest in global giants such as Apple and Facebook, along with the listed players in India. From cryptocurrencies to forex and commodities, Indian investors can also invest in multiple assets through ExpertOption. As for the platform, it has a simple yet compelling interface, which makes it easy for investors to trade and earn returns.

Contents

Why Indian traders trust ExpertOption broker?

ExpertOption operates over 80 million trading accounts worldwide. It is trusted by traders from 48 countries, who use it almost every day to supplement their portfolios. There are multiple reasons behind ExpertOption’s popularity, but the major ones include:

- Low commission

Every trading platform charges commission. There is no way around it. However, commissions can help you find the best broker. ExpertOption, for insurance, charges the lowest trading commission in the industry. It is one of the main reasons why traders everywhere, including India, trust and use ExpertOption.

- Quick deposit and withdrawal facility

Despite being an international broker having a presence in over 45 countries, ExpertOption allows investors to quickly deposit and withdraw money from their trading account. Investors can deposit and withdraw money anytime using any of the popular payment methods. Visa, MasterCard, and PayPal are some of the available options, which demonstrates the flexibility offered by ExpertOption.

- Industry-leading tools

Innovation is at the heart of ExpertOption. The broker’s mobile and web platforms offer excellent and easy-to-use features to help traders up their game. From candlestick charts to technical indicators, ExpertOption has an array of tools that can be accessed with a single click. Additionally, there is an education section, where traders can enhance their knowledge about the markets. All of these combined makes ExpertOption an appealing option for traders worldwide.

- Customer service

Customer service is another area where ExpertOption scores big. Investors can connect with a customer service representative 24/7. The team takes queries in multiple languages, including Hindi, which is especially useful for Indian traders. You can also reach ExpertOption’s customer service team via email or the form embedded into the ExpertOption mobile and desktop applications.

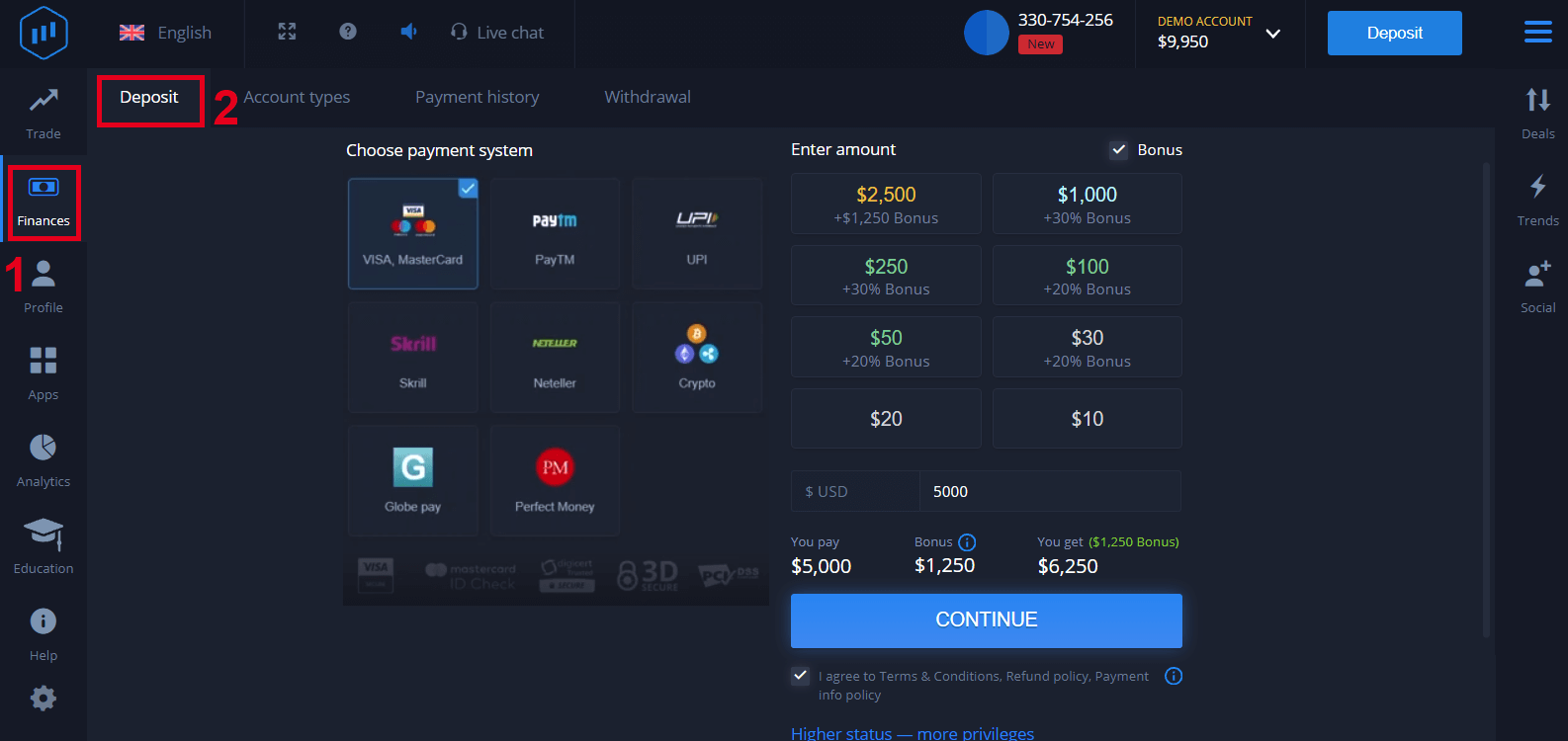

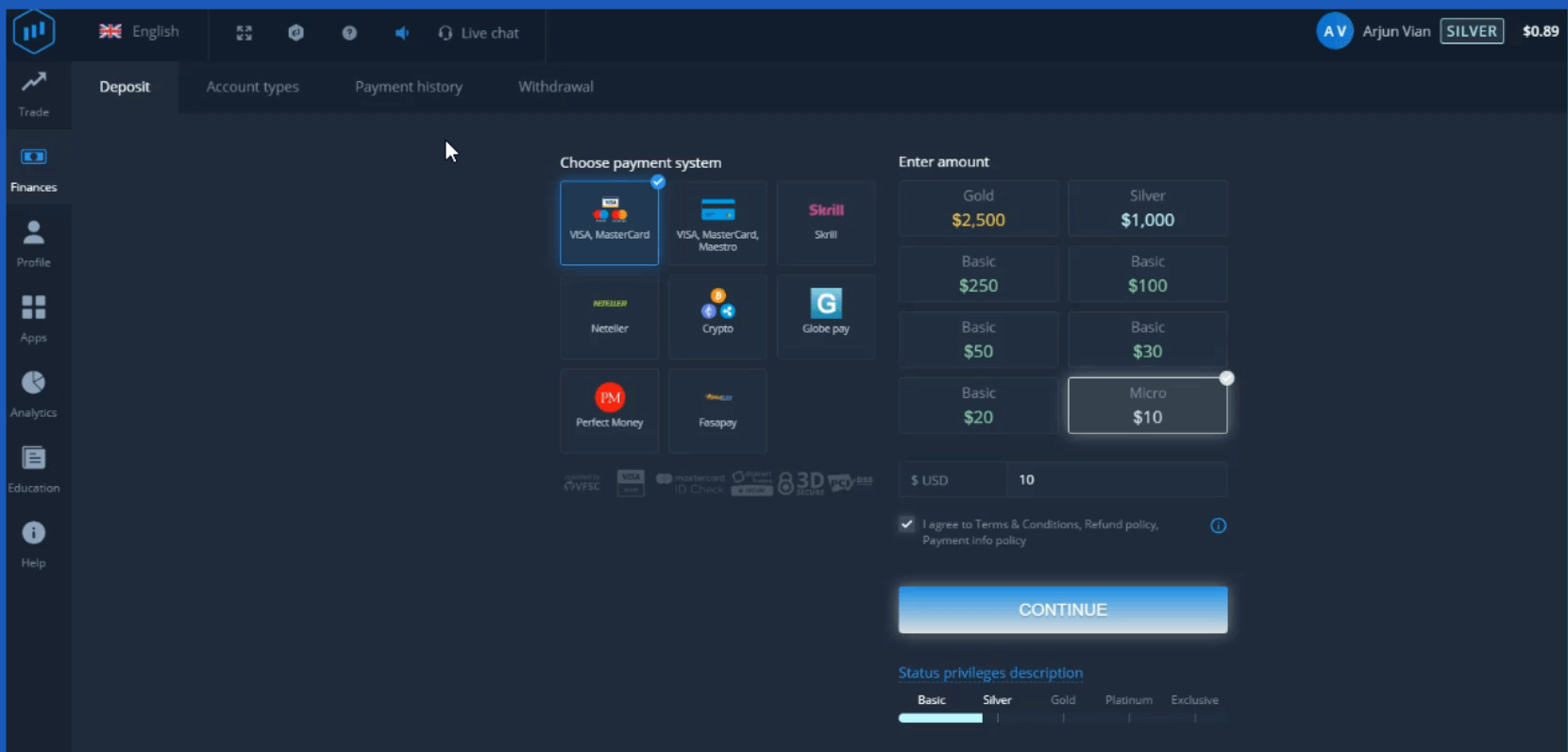

ExpertOption Deposit methods in India

Traders in India can easily deposit money into their ExpertOption trading accounts. The broker is flexible concerning the method used to make the deposit. From credit and debit cards to electronic wallets, traders can use any medium to deposit money. Using cryptocurrencies is another option for Indian traders.

All the transactions are carried out on ExpertOption’s platform, so traders do not need to worry about security. While Indian traders can deposit money using any method they want, deposits made through credit and debit cards reflect faster than other methods.

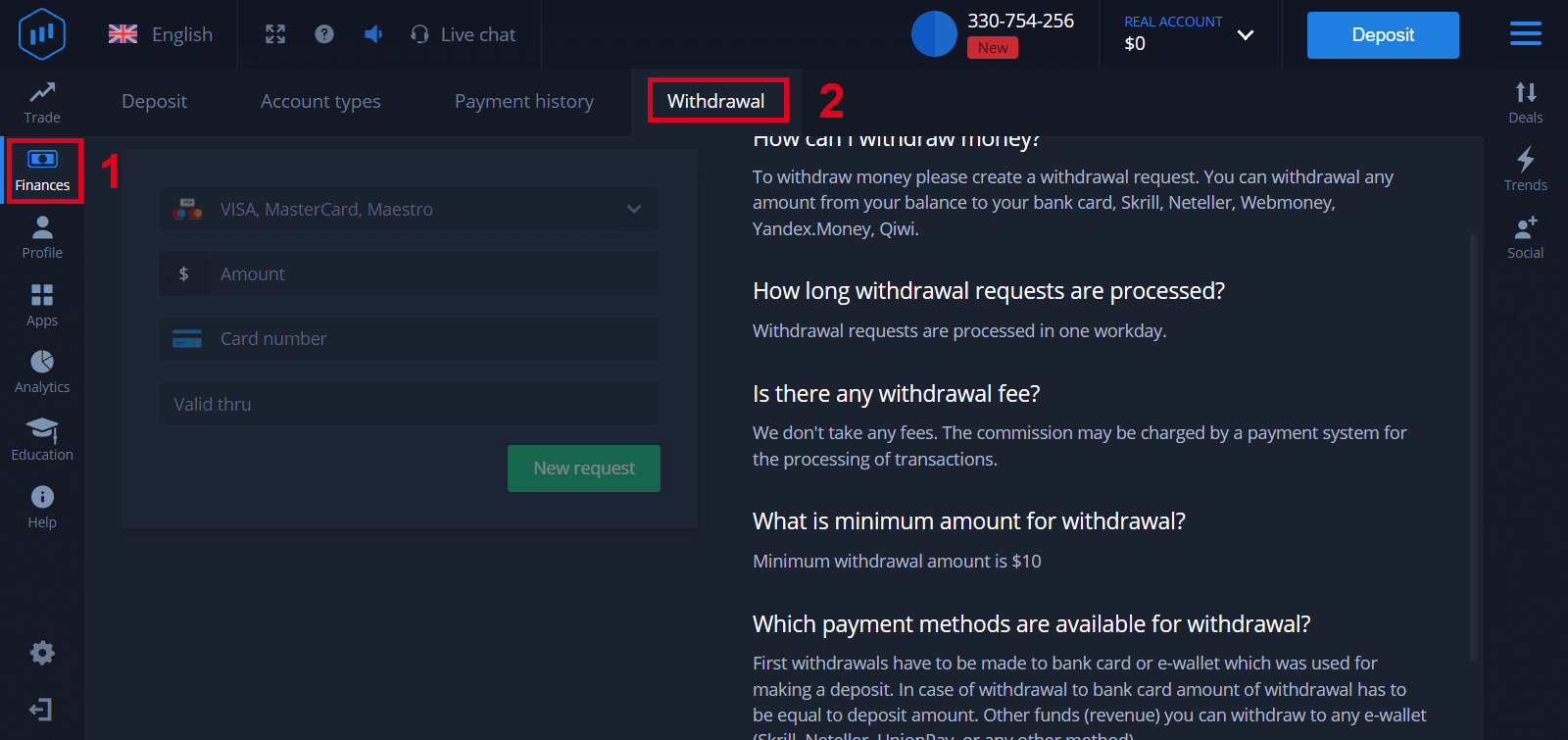

Withdraw money in India

ExpertOption makes withdrawal as easy as deposits for Indian traders. You can withdraw money using multiple methods, although some may take more time to process than others. Credit cards and E-wallets are faster than the other methods, with the money reaching your account within a few hours.

But if time is no barrier, you can withdraw money from your ExpertOption trading account in India through bank transfers and cryptocurrencies as well. The money reaches your account within a couple of days.

Verification in India

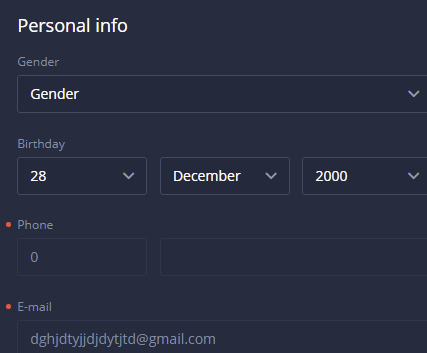

Verification is essential before you can start trading on ExpertOption in India. The online broker asks you to complete the registration process as soon as you create an account. You must:

- Provide a photocopy of your passport or Voter ID with your photo on it.

- Know your customers (KYC) details, such as the Aadhaar card and PAN card.

- Utility bill

- Picture of your bank credit or debit card.

Ensure that the details you send are accurate and clear. ExpertOption may reject your documents if the photo quality of a document is bad, or if you are younger than 18 years, according to the documents.

Limits in India

ExpertOption is used extensively by thousands of Indian traders. It is a legit platform that offers multiple benefits. As such, there are no limits to using the platform in India. However, it does have a minimum deposit and withdrawal limit that you can check on the broker’s website.

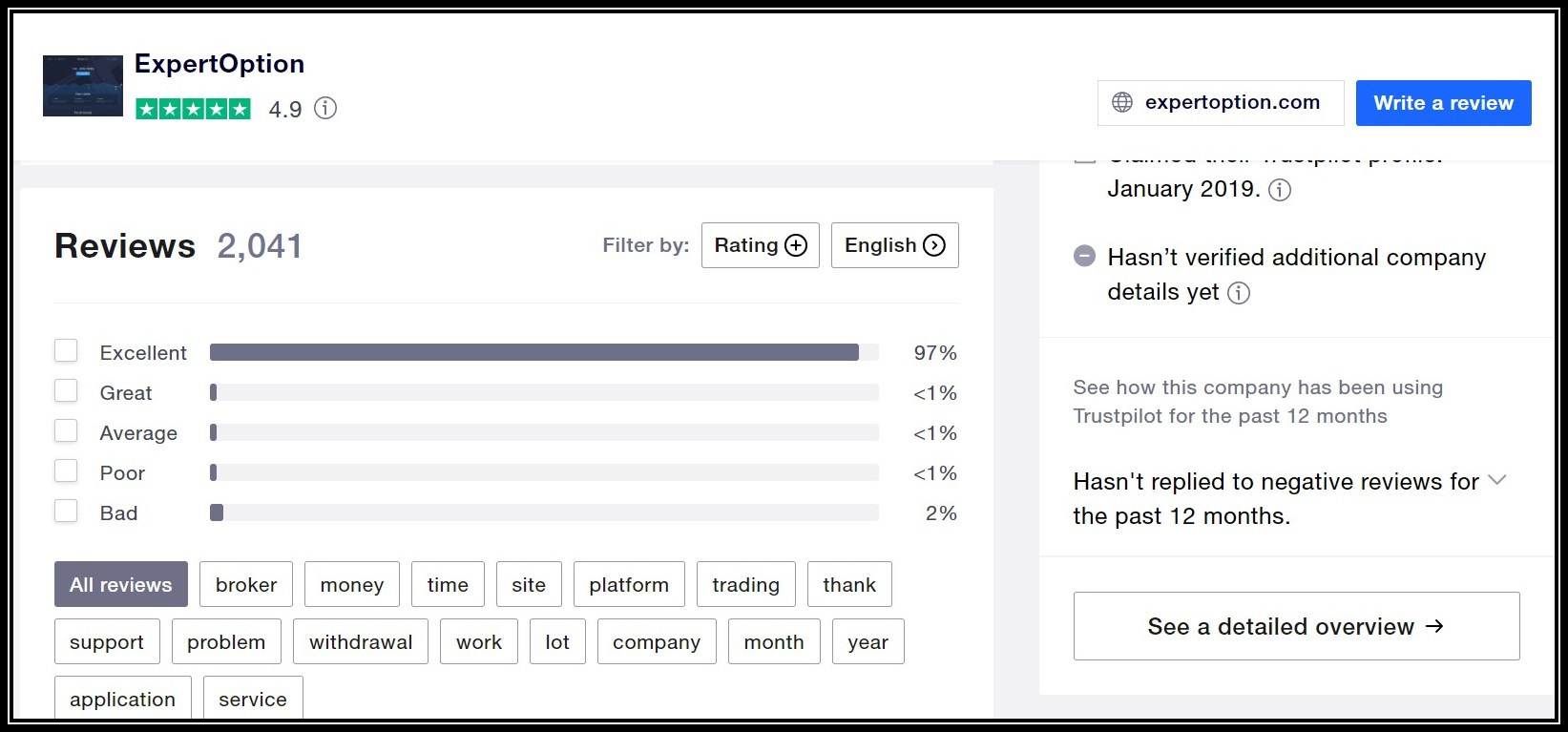

ExpertOption comments from Indian traders

Indian traders who use ExpertOption do not look elsewhere. The broker provides everything they need in a convenient and easy-to-under way. Here are some of the top reviews given by Indian traders on their experience with ExpertOption:

“I received 14,500 USD today in my Neteller account. Thank you, ExpertOption!”

“I come from India, and I earned 2000 USD today. Good broker!”

“For residents of India, the broker has created all the conditions for trading. I like everything very much.”

“I think this broker does the best for traders from India.”

“I and my friends are all in India! We all have no problems with this broker’s data!”